Understanding GHMC Property Tax

The Greater Hyderabad Municipal Corporation or GHMC Property Tax is a crucial aspect of property ownership in Hyderabad. This tax is levied on all properties within the GHMC jurisdiction and is essential for the maintenance and development of the city’s infrastructure. This article provides a comprehensive overview of GHMC Property Tax, including how to calculate and pay it, the applicable rates, and the penalties for late payment.

What is GHMC Property Tax?

The Greater Hyderabad Municipal Corporation (GHMC) imposes a property tax on all properties within its jurisdiction. This tax funds various civic amenities and infrastructure projects, ensuring the city’s smooth functioning and development. The tax rate depends on the property’s location, type, and usage.

How to Pay GHMC Property Tax Online

Paying GHMC Property Tax online is a straightforward process. Here are the steps to follow:

- Visit the Official GHMC Website: Go to the GHMC official website.

- Navigate to Online Payments: Click on the ‘Online Payments’ section and select ‘Property Tax’ from the menu.

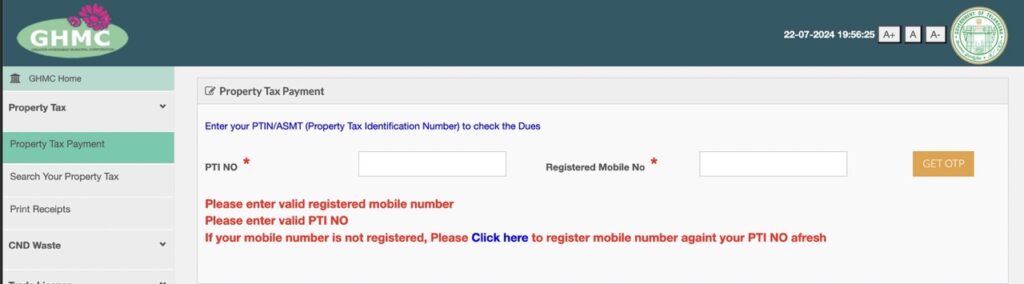

- Enter Property Details: Select ‘Property Tax Payment’ under the ‘Property Tax’ option. Enter your Property Tax Identification (PTI) number and registered mobile number, then click ‘Get OTP’.

- Verify and Submit: Enter the OTP received on your mobile and click ‘Submit’.

- Review Tax Details: Check the details about your arrears, taxable amount, arrears interest, and modifications.

- Proceed to Payment: Enter the payment amount and click ‘Proceed to Online Payment’.

- Select Payment Method: Choose a payment method from options like debit card, net banking, credit card, UPI, Google Pay, PhonePe, or wallet.

- Complete the Transaction: Click ‘Pay Now’ to complete the transaction. You can print the receipt by entering your PTI number and mobile number on the receipt page.

Offline Payment Options

In addition to online payments, GHMC Property Tax can also be paid offline. Here are some offline payment options:

- Mee-Seva Centers: Payments can be made at any of the 72 Mee-Seva centers within GHMC limits.

- Citizen Service Centers: Available in all 30 circles and the GHMC Head Office.

- Bank Branches: Payments can be made at 537 branches of 8 banks through NEFT and RTGS modes.

GHMC Property Tax Rates

The GHMC Property Tax rates vary based on the Monthly Rental Value (MRV) of the property. Here is a breakdown of the rates:

| Monthly Rental Value (Rs.) | General Tax (%) | Other Tax (%) | Total Tax (%) |

| Up to 50 | 0 | 0 | 0 |

| 51 – 100 | 2 | 15 | 17 |

| 101 – 200 | 4 | 15 | 19 |

| 201 – 300 | 7 | 15 | 22 |

| Above 300 | 15 | 15 | 30 |

How to Calculate GHMC Property Tax

Calculating GHMC Property Tax involves several factors, including the property’s size, type, and usage. Here are the steps to calculate the tax for residential properties:

- Measure the Plinth Area (PA): The plinth area includes all covered spaces like balconies and garages.

- Determine Monthly Rental Value (MRV): For self-occupied properties, find the going rate for similar properties in your neighborhood. For rented properties, use the rent per square foot specified in the rental agreement.

- Calculate Annual Rental Value (ARV): Multiply the MRV by 12 to get the ARV.

- Apply Tax Rates: Apply the relevant tax rates based on the ARV to calculate the total property tax.

To calculate your residential property tax, apply the following formula:

Annual Property Tax for Residential Property = Gross Annual Rental Value (GARV) X (17% – 30%) depending on the monthly rental value in the below table – 10% depreciation + 8% library cess.

To calculate your commercial property tax, apply the following formula:

Annual Property Tax for Commercial Property = 3.5 x P.A. in sq.ft. x MRV in Rs. per sq.ft.

GHMC Property Tax Self-Assessment

What is GHMC Property Tax Self-Assessment?

GHMC Property Tax Self-Assessment is a process that allows property owners in Hyderabad to calculate and declare the property tax they owe to the Greater Hyderabad Municipal Corporation (GHMC). This system ensures that property taxes are assessed accurately based on the property’s characteristics and usage.

Steps to Complete GHMC Property Tax Self-Assessment:

- Access the Self-Assessment Form:

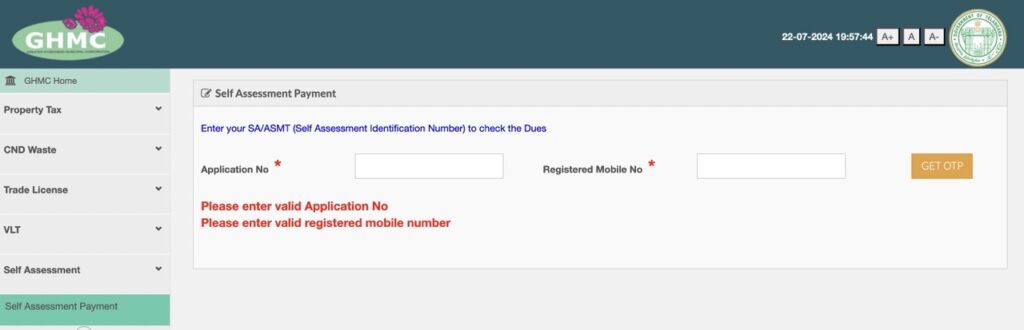

- Visit the GHMC official website and navigate to the ‘Online Services’ section.

- Select ‘Self Assessment of Property’ to access the form.

- Provide Property Details:

- Enter all necessary details, including the locality, building permission number, occupancy certificate number, nature of the building, usage, and plinth area.

- Calculate Annual Rental Value (ARV):

- The ARV is the estimated annual rent that the property can fetch if rented out. This value forms the basis for calculating the property tax.

- Submit the Form:

- After filling in all the required details, submit the form online. Ensure that all information provided is accurate to avoid discrepancies.

- Generate Property Tax Identification Number (PTIN):

- When you submit successfully, we generate a Property Tax Identification Number (PTIN) for you. Use this unique number for all future property tax transactions.

- Pay the Property Tax:

- Use the PTIN to pay the property tax online through the GHMC portal. You can make payments using online banking, NEFT, RTGS, or by visiting designated bank branches.

Benefits of Self-Assessment:

- Accuracy: Ensures that property taxes are calculated based on the actual characteristics and usage of the property.

- Convenience: Allows property owners to complete the assessment and payment process online, saving time and effort.

- Transparency: Provides a clear and transparent method for property tax calculation and payment.

Important Considerations:

- Documentation: Keep necessary documents like the building permission, occupancy certificate, and sale deed ready in PDF format for uploading during the self-assessment process.

- Timely Payment: Ensure timely payment of property tax to avoid penalties and interest charges.

Penalties for Late Payment

Timely payment of GHMC Property Tax is crucial to avoid penalties. If the tax is not paid on time, a penalty of 2% per month is levied on the outstanding amount. This penalty continues to accrue until the tax is paid in full.

Greater Hyderabad Municipal Corporation Circles and Zones

| Sl. No. | Circle No. | Name of the Circle | Name of the Zone |

| 1 | 1 | Kapra | L.B. Nagar |

| 2 | 2 | Uppal | L.B. Nagar |

| 3 | 3 | Hayathnagar | L.B. Nagar |

| 4 | 4 | L.B.Nagar Zone | L.B. Nagar |

| 5 | 5 | SaroorNagar | L.B. Nagar |

| 6 | 6 | Malakpet | Charminar |

| 7 | 7 | Santoshnagar | Charminar |

| 8 | 8 | Chandrayangutta | Charminar |

| 9 | 9 | Charminar | Charminar |

| 10 | 10 | Falaknuma | Charminar |

| 11 | 11 | Rajendra Nagar | Charminar |

| 12 | 12 | Mehdipatnam | Khairathabad |

| 13 | 13 | Karwan | Khairathabad |

| 14 | 14 | Goshamahal | Khairathabad |

| 15 | 15 | Musheerabad | Secunderabad |

| 16 | 16 | Amberpet | Secunderabad |

| 17 | 17 | Khairatabad | Khairathabad |

| 18 | 18 | Jubilee Hills | Khairathabad |

| 19 | 19 | Yousufguda | Serilingampally |

| 20 | 20 | Serilingampally | Serilingampally |

| 21 | 21 | Chandanagar | Serilingampally |

| 22 | 22 | RC Puram, Patancheruvu | Serilingampally |

| 23 | 23 | Moosapet | Kukatpally |

| 24 | 24 | Kukatpally | Kukatpally |

| 25 | 25 | Qutbullapur | Kukatpally |

| 26 | 26 | Gajularamaram | Kukatpally |

| 27 | 27 | Alwal | Kukatpally |

| 28 | 28 | Malkajgiri | Secunderabad |

| 29 | 29 | Secunderabad | Secunderabad |

| 30 | 30 | Begumpet | Secunderabad |

Benefits of Paying GHMC Property Tax

Paying GHMC Property Tax on time has several benefits:

- Avoid Penalties: Timely payment helps avoid the 2% monthly penalty.

- Civic Amenities: The tax revenue is used to maintain and improve civic amenities like roads, parks, and public utilities.

- Legal Compliance: Ensures compliance with municipal regulations, avoiding legal issues.

Conclusion

GHMC Property Tax is a vital component of property ownership in Hyderabad. Understanding how to calculate and pay this tax ensures compliance with municipal regulations and contributes to the city’s development. Whether you choose to pay online or offline, timely payment is essential to avoid penalties and support the maintenance of civic amenities. For more detailed information, always refer to the official GHMC website or contact their customer service.

Frequently Asked Questions (FAQs):

Q: What is GHMC Property Tax?

A: Property Tax is a tax levied by the Greater Hyderabad Municipal Corporation (GHMC) on property owners in Hyderabad to fund various civic amenities and infrastructure projects.

Q: Who is required to pay Property Tax?

A: All property owners in Hyderabad must pay GHMC Property Tax annually for their residential, commercial, and institutional properties.

Q: How is Property Tax calculated?

A: The calculation of tax uses the Annual Rental Value (ARV) of the property, considering factors like location, type of property, and its usage.

Q: What is the Annual Rental Value (ARV)?

A: ARV is the estimated annual rent that a property can fetch if it is rented out. It forms the basis for calculating the property tax.

Q: How can I pay Property Tax online?

A: You can pay the tax online through the GHMC official website by entering your Property Tax Identification Number (PTIN) and following the payment instructions.

Q: What is a Property Tax Identification Number (PTIN)?

A: Each property receives a unique PTIN for property tax assessment and payment.

Q: Are there any exemptions available for Property Tax?

A: Yes, certain categories of properties, such as those owned by charitable institutions, religious organizations, and government properties, may be eligible for exemptions.

Q: What happens if I fail to pay Property Tax on time?

A: Failure to pay the tax on time can result in penalties and interest charges. The GHMC may also take legal action to recover the dues.

Q: Can I pay Property Tax in installments?

A: Yes, GHMC allows property owners to pay the tax in two installments, typically in the first and second halves of the financial year.

Q: How can I check my GHMC Property Tax dues?

A: You can check your dues online by entering your PTIN on the property tax portal.

Q: What are the modes of payment for Property Tax?

A: You can make payments online via the GHMC website, at Mee-Seva centers, citizen service centers, and designated bank branches.

Q: How can I update my property details for Property Tax?

A: Property owners can update their property details by submitting the necessary documents and forms at the GHMC office or online.

Q: What documents are required for Property Tax assessment?

A: For property tax assessment, you typically need to provide documents such as the sale deed, occupancy certificate, and building plan approval.

Q: Is there a helpline for Property Tax queries?

A: Yes, GHMC provides a helpline and customer service centers to assist property owners with their tax-related queries.

Q: Can I get a receipt for my GHMC Property Tax payment?

A: Yes, after you make the payment, you can download the receipt from the property tax portal for your records.